Are HOAs Considered Non-Profit Organizations?

4.7 (406) In stock

4.7 (406) In stock

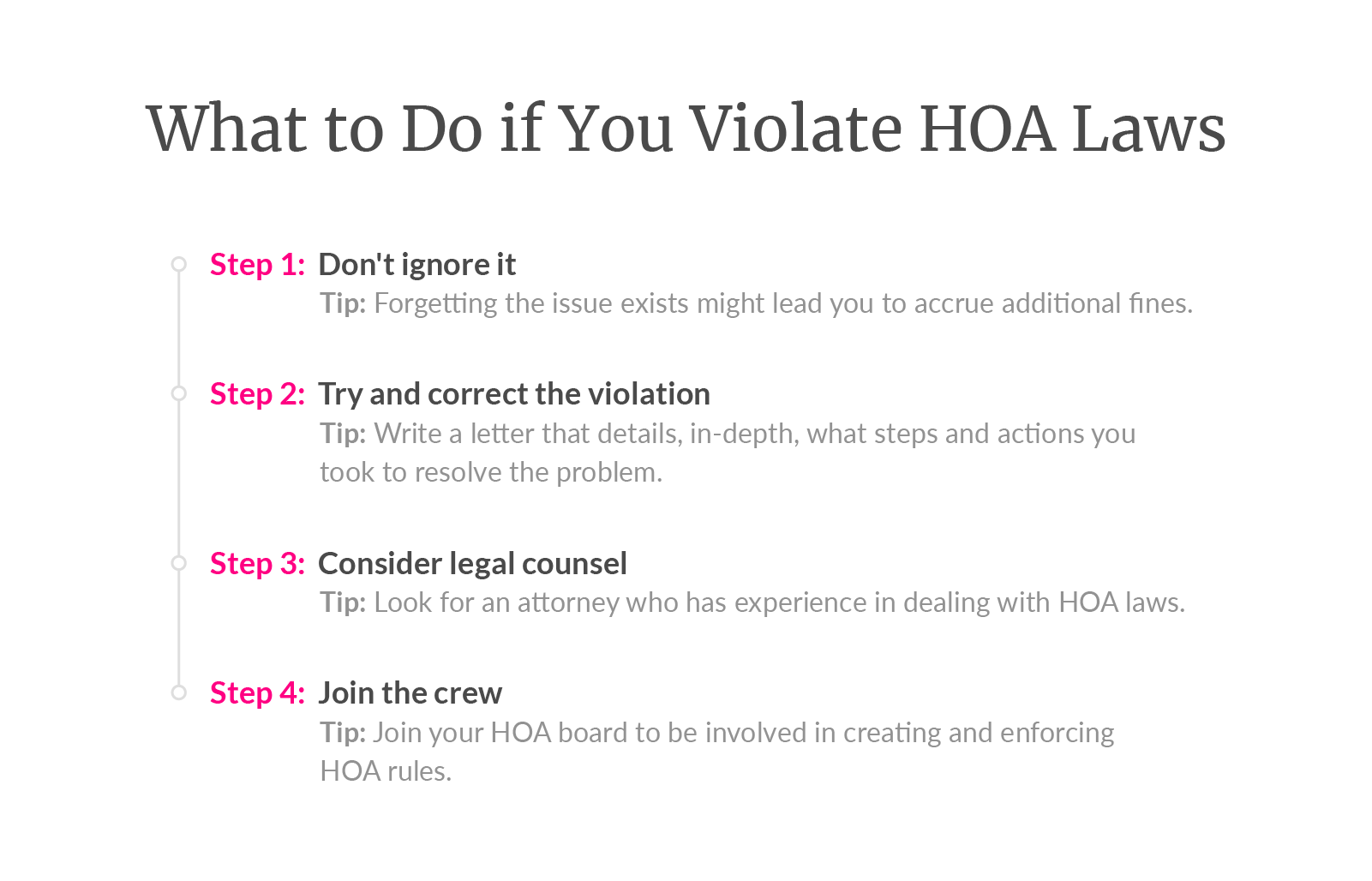

Homeowners’ associations are often organized as non-profits. By incorporating non-profit status into the bylaws of the community, the association is always registered as a non-profit. So, how does the IRS treat an HOA? Are homeowners’ associations corporations? Do HOAs have to file tax returns and pay taxes? These are very common questions and ones that

HOA vs homeowner repairs; who is responsible for what?

HOA vs No HOA: How A Homeowners Association Can Affect Your Property Value

HOA Rules & Regulations Explained • Lemonade Insurance

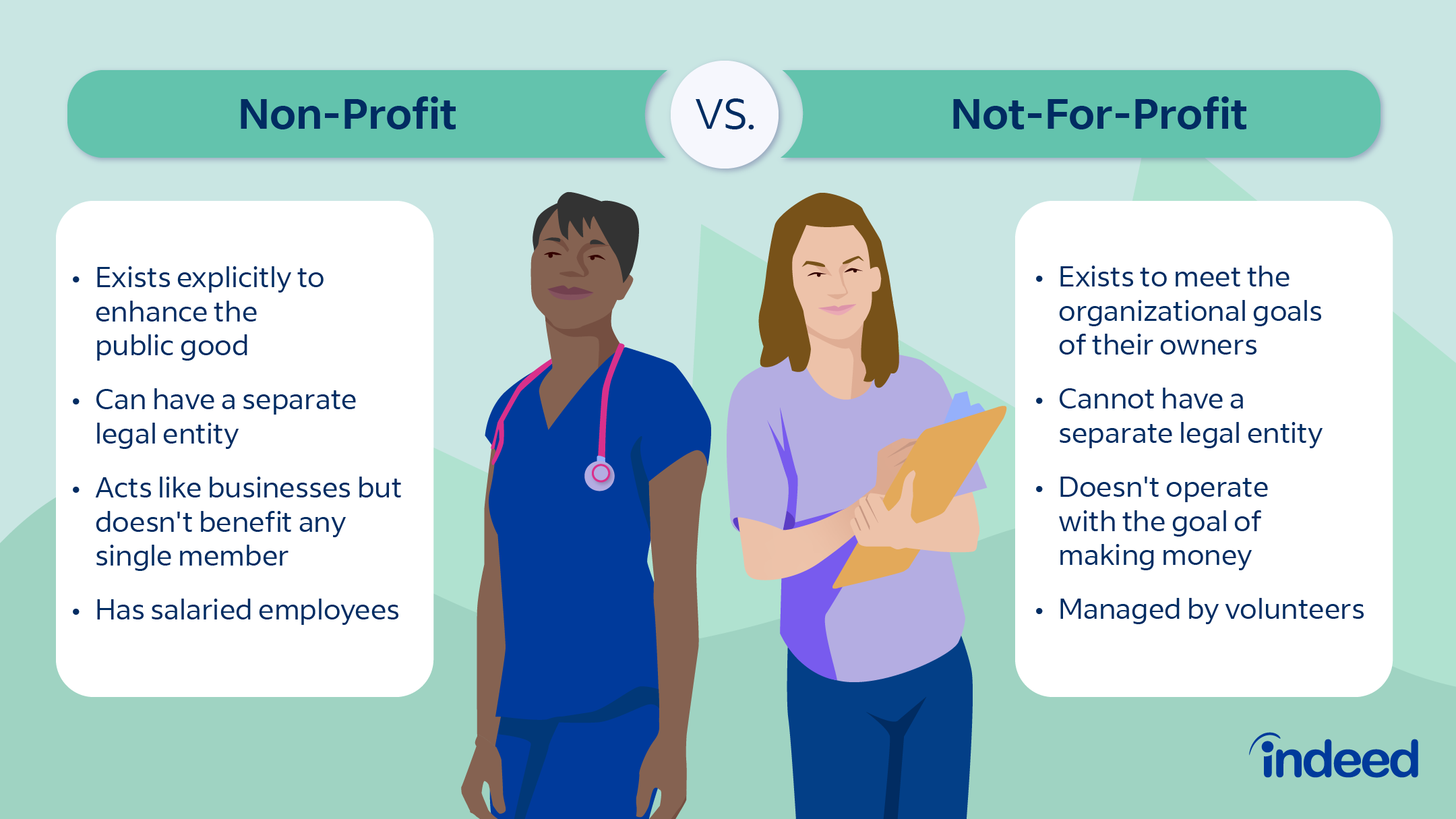

For-Profit vs. Non-Profit Organizations: Key Differences

The Corporate Transparency Act and its Impact on Homeowners Associations - Felhaber Larson

The value of an HOA - HOAresources

The Benefits of Joining a Homeowners Association, by Collins And Associates

10 Tips for Dealing With Your Homeowners Association

The Best Nonprofit Website Builders in 2022

/2019/08/27145701/What-is-an-HOA.j

What are articles of incorporation for HOA?