Credit Suisse: Too big to manage, too big to resolve, or simply too big?

4.5 (261) In stock

4.5 (261) In stock

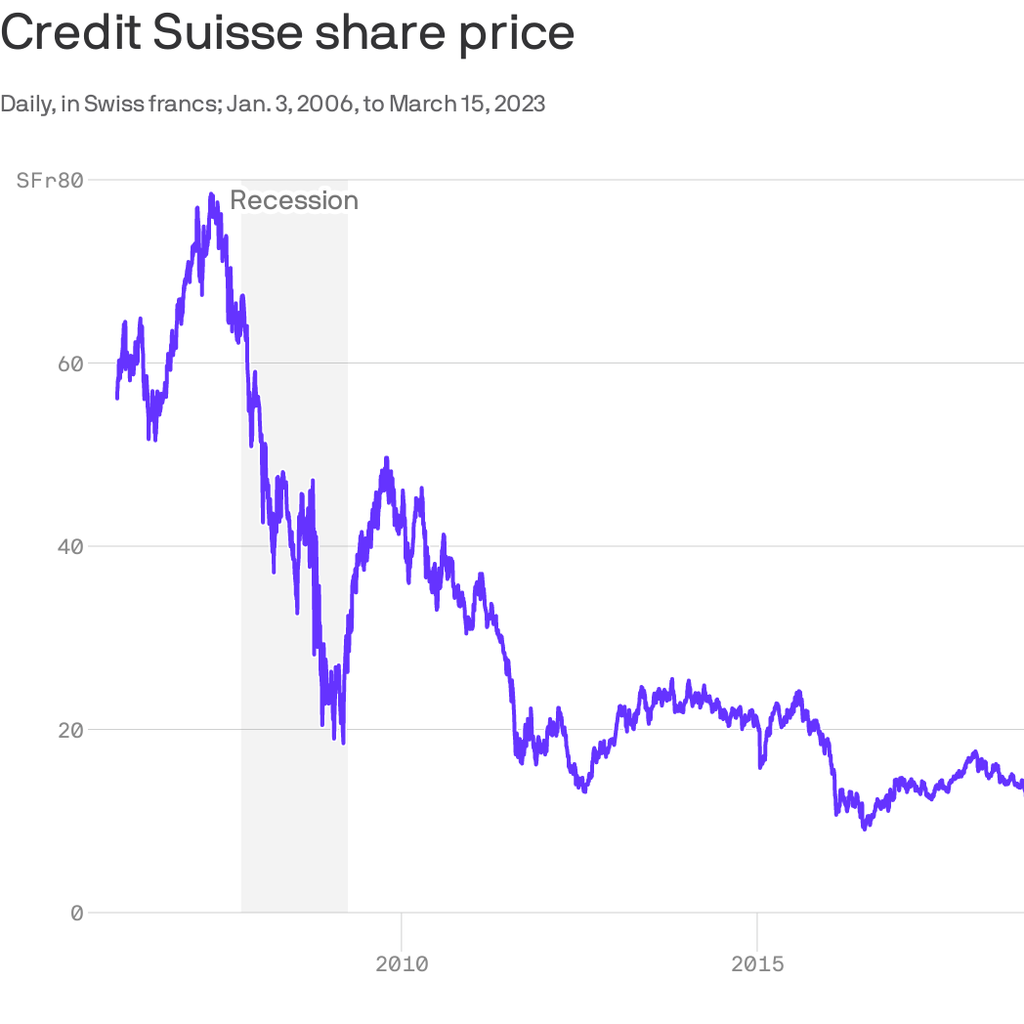

The runs on Silicon Valley Bank and Credit Suisse in March 2023 revived attention on banking regulation, resolution, and government intervention. This column analyses the details of the run on Credit Suisse and its eventual takeover by UBS. It highlights multiple discrepancies between official statements and implemented measures, both by Credit Suisse and Swiss authorities. Furthermore, it argues that the reforms adopted after the 2007-2009 crisis are still insufficient for resolving systemic institutions. Going forward, authorities must be able to act promptly and implement correction actions before risks of failure become too severe.

Too Big to Fail: Definition, History, and Reforms

Is UBS the new Swiss government (bond)?

Too Big To Fail: Andrew Ross Sorkin, PDF, Lehman Brothers

2024 banking industry outlook

Credit Suisse: Too big to manage, too big to resolve, or simply

How does UBS's takeover of Credit Suisse stack up financially? - The Banker

Is Credit Suisse too big to be saved?

enewsfeb24_banner_2.jpg

Eight Days The New Yorker

Public backstops during crises in 2022-2023

Why we should care about Credit Suisse's problems

How the FDIC Keeps US Banks Stable

Lessons from missing the signals of failing banks